China's maleic anhydride export market showed resilience amid global economic complexities, with H1 exports exceeding 100,000 tons. However, growth slowed amid intensified "volume-for-price" competition. H2 exports are expected to grow but face pressure from oversupply and global uncertainties.

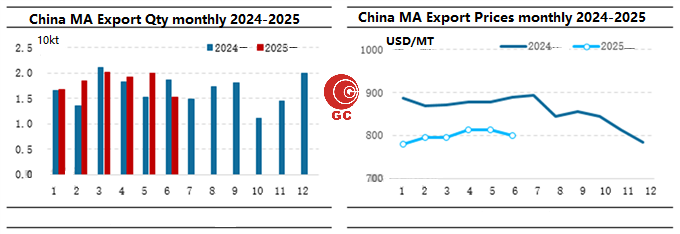

1. Volume Up, Price Down Exports: 109,758 tons (Jan-Jun 2025), +6.13% YoY. Growth Rate: Slowed by 36.53 ppt vs. 2024. Average Price: $799.90/ton, -8.96% YoY. Reflecting fierce competition and cost-driven expansion despite strong global adaptability.

2. Trade Partners: Concentrated Yet Diversifying Top 10 markets absorbed 72.81% of exports. Top Buyers: India: 37,921 tons (-9.30% YoY) UAE: 7,210 tons (+19.84%) Italy: 6,435 tons (+99.44%) Regional Shifts: Europe (20.97% share, +9.09 ppt): Led by Italy, Belgium (+183.94%), Netherlands (+132.22%). Southeast Asia (10.98%, +1.72 ppt): Driven by Indonesia (+70.20%), Singapore (+82.92%). Latin America/Middle East/South Asia shares declined.

3. Domestic Shippers: New Leaders Emerge Emerging Provinces: Jiangsu: 8,381 tons (+485.47%) Liaoning: 7,266 tons (+216.36%) Guangdong: 14,669 tons (+82.93%) Traditional Leaders: Shandong: 41,756 tons (-4.94%) Henan: 18,063 tons (-27.47%).

(Data Source: General Administration of Customs People's Republic of China)

Edited by: Jeffery Cheng